Tories must now come clean about where their £12bn of welfare cuts will be made

The unexpected Conservative majority means they cannot back down

When the Conservative manifesto confirmed plans to cut £12bn from welfare, some senior Tories thought the party would never have to implement them.

They did not expect to win an overall majority and knew that the Liberal Democrats would accept only about £3bn of social security cuts in another coalition.

There was a natural deal to be done under which David Cameron backed down from £12bn of welfare savings and, in return, Nick Clegg let him have an in/out referendum on Europe. George Osborne could have filled the hole by raising taxes for the better off – and blaming it on the Lib Dems.

But now the Prime Minister and Chancellor have no excuses and must trim welfare by £12bn. It will not be easy. And it could revive memories of the “nasty party” just when Mr Cameron, with an eye on the 2020 election, is relaunching the Tories as a “One Nation” party which champions working people.

Indeed, one of the cuts already planned would undermine that. Mr Osborne announced last October that most working-age benefits would be frozen for two years from April next year, which is likely to hit 11 million families. It would save £1bn.

The Queen’s Speech on 27 May will include a Bill to reduce the cap on benefits that can be claimed by one household from £26,000 to £23,000 a year. Opinion polls show that this headline- grabber is popular with voters, but it would not save very much – about £135m a year.

The plan to remove housing benefit from jobless 18 to 21-year-olds, who will be expected to live with their parents unless there are exceptional circumstances. This would save about £100m. They have also pledged to replace Jobseeker’s Allowance for 18-21 year-olds with a youth allowance limited to six months.

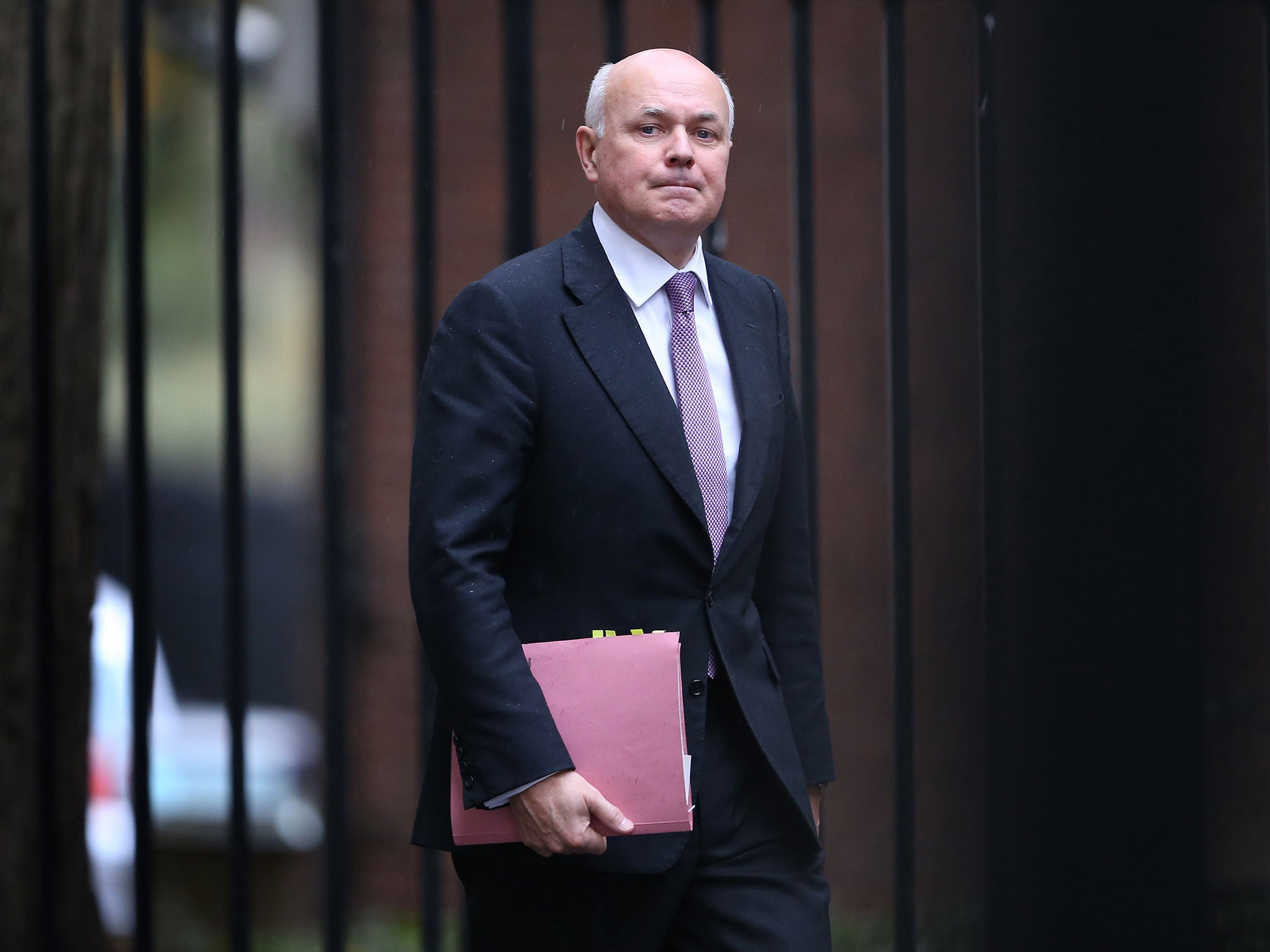

So Mr Osborne has found only about £2bn of the £12bn he needs. During the election campaign, Labour and the Lib Dems accused him of having a “hidden agenda” of cuts but Iain Duncan Smith, who has been reappointed Work and Pensions Secretary, was almost certainly telling it straight when he said the Tories had not yet done the work on finding the rest of the savings.

Their room for manoeuvre is limited. About £121bn of the £220bn welfare budget goes on pensioners and is protected. The state pension is covered by a “triple lock” under which it rises each year by prices, earnings or 2.5 per cent, whichever is highest (and 2.5 per cent is generous at a time of low or zero inflation). Mr Cameron did not join Labour and the Lib Dems in pledging to axe perks such as winter fuel payments and free bus passes and television licences from better off pensioners.

So what could the new Government do? According to the Institute for Fiscal Studies (IFS), the ring-fencing of spending on pensioners means the Tories will have to lop about 10 per cent off the budget for other benefits – most of which goes on working age households in the bottom half of the income scale. Hardly very “One Nation”.

Appointments in David Cameron's Tory government

Show all 7The IFS said options could include saving £5bn by abolishing child benefit and compensating low-income families through universal credit, which will merge six benefits including tax credits. Reducing the child element of universal credit by 30 per cent could save £5bn. Although Mr Cameron promised not to cut child benefit and tax credits during the election campaign, Labour claims he did not rule out some changes. One option would be to mask the cuts by reducing tax credits instead of launching a full-frontal attack on child benefit, which could alienate middle income families. Mr Duncan Smith has floated the idea of limiting child benefit to the first two children. Mr Osborne is said not to be keen. This change might eventually save £1bn a year but would almost certainly not apply to existing children, which would be very controversial.

Housing benefit, which costs £19bn a year, is a likely target. Making all claimants pay at least 10 per cent of their rent would raise £2.5bn.

A more controversial option would be to pare benefits for the disabled. Taxing disability living allowance, personal independence payments and attendance allowance would save about £1.5bn. But Mr Cameron and Mr Osborne hinted during the election that the most vulnerable would be protected, and hitting the disabled would hardly chime with “compassionate Conservatism”.

The Prime Minister and Chancellor have played down the hard task ahead, pointing to £20bn of savings in the last parliament. But the low-hanging fruit has been picked. For example, about half the savings since 2010 have been achieved by curbs such as raising benefits in line with the consumer price index rather than the higher retail prices index. There are no soft options left.

Three Paths to Cuts

Scenario One: The Conservatives “bite the bullet” and push through controversial cuts affecting the disabled, child benefit and tax credits.

The “nasty party” label is revived but George Osborne hopes the storm will blow over by the 2020 election.

Scenario Two: David Cameron and Osborne decide that £12bn of welfare cuts would undermine their revived “compassionate Conservatism”. They quietly settle for much less and slow the pace of the cuts set out in the Budget in March 2016.

Scenario Three: The middle way. £6bn of savings are found without provoking screaming headlines. Disability payments and child benefit are not affected. Housing benefit is curbed and tax credits cut “by stealth” during the phased introduction of universal credit.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies